Aspire Cash

Aspire Cash transforms how you deliver cash based financial support to students and other beneficiaries.

Developed with NatWest’s Payit solution, Aspire Cash unlocks the benefits of open banking, meaning:

- Hardship and emergency funding reaches beneficiaries in minutes, 24/7 – 365 days a year.

- No more collecting, verifying and storing student bank account details – ever.

- No need to collect student mobile phone numbers in order to verify payments.

- Deliver a better, digital student experience

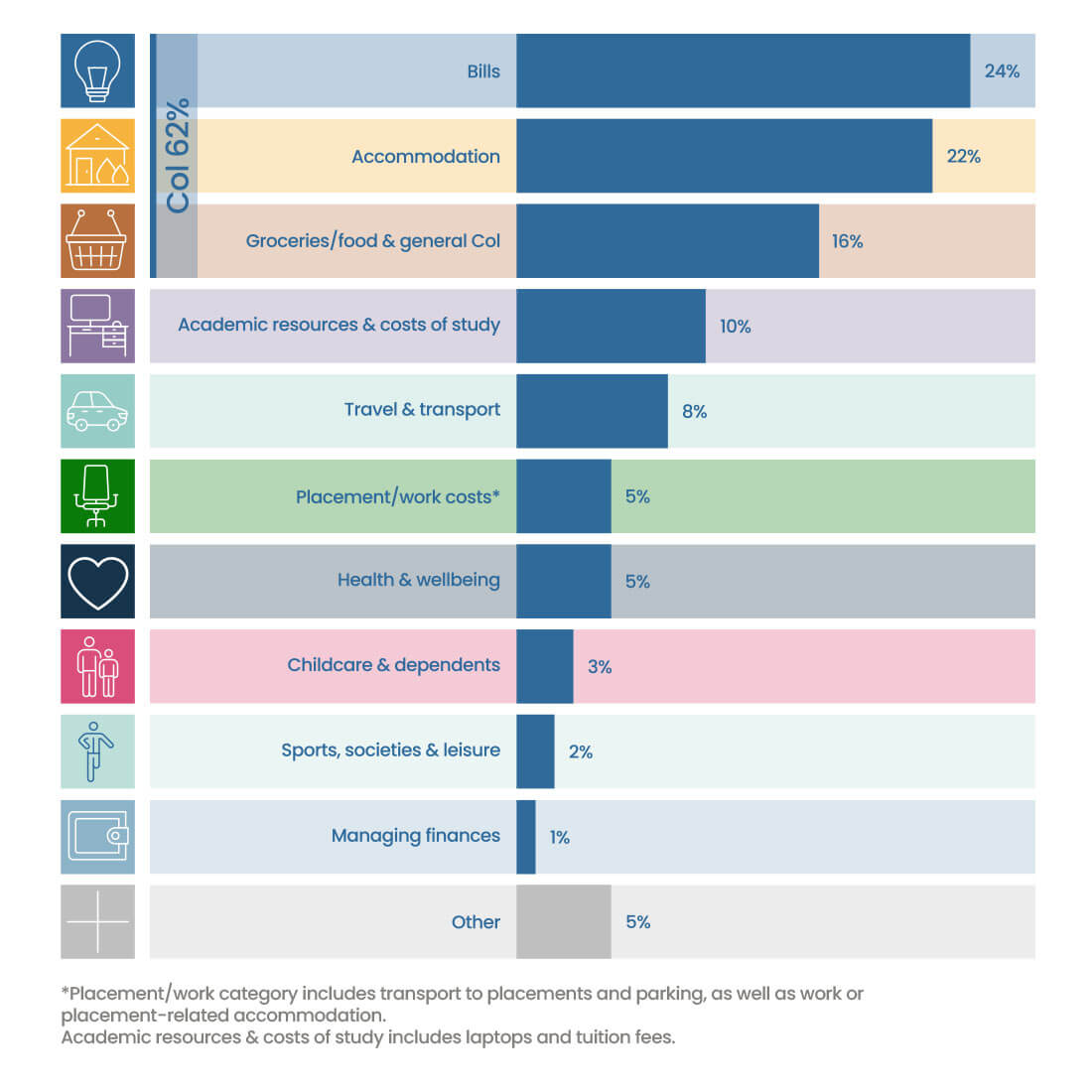

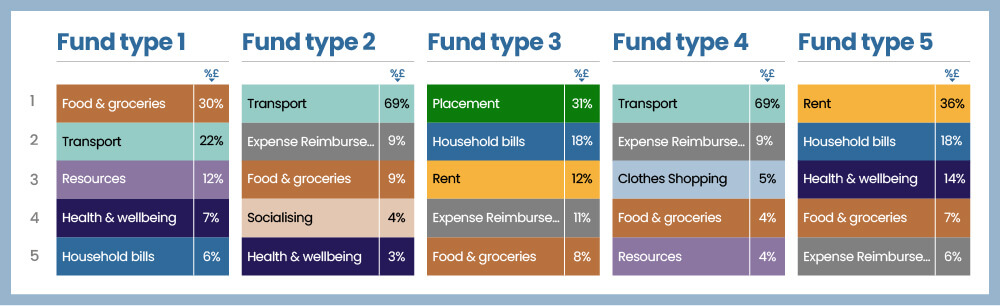

- Understand how students are using their cash

- Achieve measurable administrative and overall time and cost savings.

"Being able to get money to students 24/7 makes the task so much easier. Students feel instant relief when they know money is on its way today. This is a really welcome initiative for the whole HE sector. The Aspire Cash process also reduces our administrative costs and gives us excellent data about what students spend emergency cash on. That really helps build our understanding of student needs and behaviour in the current climate."

Ben Dale, Director of Finance, University of Sunderland

Aspire Credit

Give more impact to your financial support.

With Aspire Credit you can provide funds to beneficiaries that are ring-fenced to be spent on products, resources and services that will support positive outcomes and help them make the most of any support awarded to them.

Credit can be tailored to each beneficiaries needs and the priorities of each funder, specifically addressing student & beneficiary resource requirements be that course resources or highly targeted issues such as food or digital poverty and setting up home.

We support each Aspire Credit scheme with:

- An engagement portal where beneficiaries can find recommended products & resources and a wealth of free information, advice and insights.

- A dedicated engagement partner to support successful management of the scheme.

- Detailed reporting and data insights into how funds are being used.

"It’s really tackled the need for levelling-up of all of our students when it comes to digital access and to enabling students to be able to access courserelated resources, without the usual financial barriers. We’ve developed a strong reputation for what we’ve been doing in digital support and have been winning awards for this refreshing approach."

Professor Mark Simpson, Deputy Vice-Chancellor of Teesside University

Aspire Vouchers

Support or reward your students or beneficiaries.

Vouchers can be a great way of supporting beneficiaries with the cost of living or reward them for volunteering or research activity.

With Aspire Vouchers you can get cost of living or gift vouchers to students instantly, including ‘grocery only’ vouchers to directly address food poverty.

Retailers working with Aspire Vouchers include: Aldi, Tesco, Sainsbury, Asda, Morrisons and Iceland.

“It was about taking the opportunity to provide a much better service to our students. Getting all of the payments to our students to go through one platform, rather than a multitude of different or many different types of payments. It’s a significant opportunity and success for us.”

Nicholas Brierley, ULan’s Head of Financial Processes.

Aspire ATM

Aspire ATM enables unbanked beneficiaries, or those experiencing a genuine emergency, to withdraw cash directly from an ATM using just their mobile phone – no bank account or bank card needed.

Using our latest cardless cash solution, Aspire ATM, means you can get cash to beneficiaries in minutes. An SMS is sent to the beneficiary, which includes all the details required. This information is entered into any of the 15,000 Cashzone ATMs to withdraw the cash in seconds using the cardless withdrawal functionality – no bank account or bank card needed.

As you don’t need to hold bank account details or card information of the beneficiary, you are also reducing your GDPR risk while delivering vital funding in a matter of minutes.